There are two sides to the institution of marriage. One is personal: You find a partner you love and want to share your life with. The other is legal, in which you enter a contract to share assets, debts, and custody of any children you may have together.

With this in mind, more Texas couples are opting for prenuptial agreements, also called premarital agreements, to set the financial terms of their marriage.

What is a prenup, and how could it protect you in the event of divorce? There are a few things you need to know, and a Fort Worth prenuptial agreements attorney from Mims Ballew Hollingsworth (MBH) can answer the questions you didn’t even think to ask.

What Is a Prenuptial Agreement?

A prenuptial agreement is a written contract agreed to and signed before a couple signs a marriage license. It goes into effect at the time of the marriage. The contents of this contract typically specify how the couple will split marital assets and debts in the event of divorce.

A prenup may protect certain assets that one partner brings into the marriage, such as real estate, a family inheritance, or a business. It could also include stipulations about income, such as how much spousal support might be provided to a lower-earning spouse or to a spouse who forgoes career interests to care for children. It could have provisions regarding what the parties will inherit upon the death of the other, and address inheritances for children from previous relationships.

Some prenups may include deal-breakers like infidelity. What happens if you sign a prenup and get divorced with an infidelity clause in place? The prenup could specify financial penalties if such behavior is proven.

There are some common misconceptions about prenups that an experienced attorney can set straight. Just because you’re starting married life with little wealth or few assets doesn’t mean you won’t amass them during your marriage. With a prenup, you can realistically plan for the future.

Not all prenup provisions are enforceable. For example, child custody and child support agreements must be approved by the court and serve the best interests of children. A judge’s ruling will override any such provisions that involve children.

Why Consider a Prenuptial Agreement?

There are several reasons to consider a prenuptial agreement. This legal contract is often used to address ownership of premarital assets or distinguish business interests from marital property. It’s also ideal if you want to protect your inheritance from a spouse.

Prenups offer financial transparency and peace of mind that will serve you well during the heightened emotions of a divorce, minimizing disputes and speeding up the process. Perhaps this is why more Americans are open to the idea of prenuptial agreements.

A prenuptial agreement offers financial benefits to couples even if they never divorce. It can promote transparency, encourage open discussions about financial expectations, and clarify each partner’s financial responsibilities. It can help manage debt, protect individual assets or inheritances, and define what is considered separate versus shared property. By outlining these details in advance, a prenup supports effective financial planning, reduces misunderstandings, and can help couples align their long-term financial goals, ultimately strengthening their financial partnership throughout the marriage.

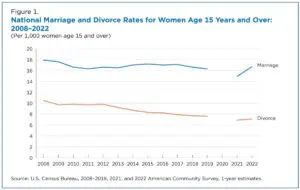

Divorce Rates, Marriage Rates, & Premarital Agreement Adoption

CDC data shows declining divorce rates over a 15-year period. Over that same period, marriage rates have fluctuated slightly but declined more slowly than divorce rates.

A 2023 Axios/Harris Poll found that 50% of adults support prenups, up from 42% the previous year. A significant percentage of Gen Zers are jumping on the bandwagon, with 41% of engaged couples and 47% of married respondents saying they entered a prenup.

Instead of making divorce more likely, prenups can alleviate stress and potentially make marriage a more attractive proposition.

Legal Requirements for a Valid Prenuptial Agreement in Texas

Couples make many promises before marriage, but if you want the legal system to support these promises, you must put them in writing. A valid prenuptial agreement in Texas has these key requirements:

- Written and signed by both parties

- Voluntary execution

- Full financial disclosure

If these requirements are not met, your prenup may be invalid and unenforceable. This is why it’s so important to consult an attorney to ensure your contract is binding.

Written and Signed by Both Parties

Like any legal contract, a prenup must show the agreement of all parties involved by way of their signatures. The content of this contract is flexible, and couples can customize the terms to reflect their lives and relationship. But if it isn’t signed, it’s not valid.

Verbal agreements to things like spousal support and property division are not considered binding, which means they’re not enforceable. If protecting your assets and your future is important, you and your fiancé must specify your plans in writing and sign on the dotted line.

Voluntary Execution

Although many couples are on the same page when it comes to a prenup, some situations are driven by one party and reluctantly agreed to by the other. This could lead to a legal battle in the event of a divorce.

Both parties must voluntarily agree to the terms for a prenuptial agreement to be valid. Each party must have sufficient time to review and fully understand the content of the contract. In other words, they must know what they’re agreeing to.

In addition, this document can’t be signed under duress. If you’re pressured, coerced, manipulated, or forced to sign something you don’t understand or agree to, a judge could deem the prenup invalid.

Full Financial Disclosure

Fraud is a disqualifying factor in contracts, including prenuptial agreements. The basis of any contract is honesty. If one party is trying to lie or cheat, there is no foundation for the other party to make an informed decision about the agreement.

In the case of a prenup, this means full disclosure of each party’s assets, debts, and financial circumstances. The contract should also include provisions for future financial obligations, such as student loan debts or spousal support.

Typically, a prenup covers financial matters like these:

- Management and control of property

- Division of assets

- Spousal support

- Wills, trusts, and other estate planning

- Death benefits from life insurance policies

- Other personal rights and obligations

The terms of the prenup are based on what assets and debts each party brings into the marriage, as well as the potential future financial circumstances of the couple. Any falsehoods or omissions may make the contract unenforceable.

How Much Does a Prenuptial Agreement Cost in Texas?

The cost of a prenuptial agreement in Texas depends largely on the complexity of your finances. A simple contract featuring relatively few assets, debts, and stipulations could cost you as little as about $500.

On the other hand, you might pay upwards of $3,000 for a contract that includes significantly greater assets or complex arrangements. If negotiations drag on or one or more parties require several changes and drafts, the price will go up. Pricing is also dependent on attorney fees.

The best way to enter negotiations for a prenuptial agreement is to work out the details with your partner beforehand. This will set the stage for a smooth and speedy process with no surprises.

How to Get a Prenuptial Agreement in Texas

Creating a prenuptial agreement doesn’t have to be a lengthy or stressful process. There are four main steps:

- Step 1: Gather financial documents

- Step 2: Consult a qualified family law attorney

- Step 3: Draft the agreement and review it separately

- Step 4: Sign with witnesses or a notary public

Your attorney will want to review your financial documents, so it’s best to gather them before your consultation. These documents would include:

- Proof of income (pay stubs, tax returns, etc.)

- Bank statements

- Investment account statements

- Future inheritance information (such as a trust)

- Real estate deeds

- Vehicle titles

- Listing of tangible property (jewelry, collectibles, etc.)

- Business documents, if applicable

- Accounting of debts (loans, credit cards, medical bills, etc.)

Both you and your partner should have separate legal representation. This ensures that your interests are protected, and it makes the prenup more likely to hold up in court.

With the information you provide, your lawyers will work to draft a contract that reflects the financial circumstances of both you and your partner and spells out your wishes. You will have time to review the document and make changes if necessary. Finally, you will formally sign the contract in the presence of witnesses or a notary.

Prenuptial vs. Postnuptial Agreement

What if you get married without a prenuptial agreement but decide you would like one after the fact? It’s not too late to consult with a Fort Worth postnuptial agreements attorney.

A postnuptial agreement is similar to a prenup, except that it is created and signed after the couple is already married. It can be signed at any time after the marriage license is filed.

However, these agreements are sometimes more difficult to enforce than prenups. Courts may approach a postnuptial agreement with a higher level of scrutiny due to the greater potential for issues like coercion or duress. Contracts that are transparent and fair to both parties are more likely to pass muster.

The primary reason to create a postnuptial agreement, as opposed to a prenup, is because of a change in financial circumstances after marriage. It could be prompted by an unexpected inheritance or major debt, such as student loans or medical bills. In other cases, as couples mature, they see the wisdom in clarifying financial responsibilities.

How to Ensure Enforceability

The enforceability of any contract relies on validity and conformity to the law. An experienced Southlake prenuptial agreements attorney can help you understand what this means and how it relates to your prenup.

Enforceability starts with meeting Texas requirements for full disclosure and making sure that the written and signed agreement is entered into voluntarily by both parties. The agreement must avoid terms that could be viewed as unconscionable, unfair, or at odds with Texas laws.

It’s also wise for both parties to retain separate legal counsel. Having a single lawyer represent both parties isn’t unheard of, but it could be considered a conflict of interest. Instead, each partner should hire a lawyer who is responsible for representing their best interests.

Common Misconceptions About Prenuptial Agreements

If you started a business with another person, no one would bat an eye when you asked for a contract to spell out the terms of your partnership. Yet, there are stigmas and misconceptions associated with signing a prenup that sets financial terms for a marriage. Perhaps this is because a business is a professional relationship, while marriage is personal.

A prenuptial agreement will not jinx a marriage, planting the seeds of divorce before the couple ever ties the knot. Some couples, however, find that a prenup helps them begin their marriage more attuned to each other’s needs and expectations.

A premarital agreement does not mean you are entering your marriage thinking it will end in divorce. During a marriage, circumstances can change. One or both parties can change over time as well. Taking measures to protect your financial future just makes sense.

It’s also a common myth that prenups are only for wealthy people — that they’re unnecessary if you have no assets. The truth is that many couples acquire a lot of assets (and debts) during a marriage. A prenup puts protections in place that protect both parties should there be changes to the couple’s situation.

Let MBH Help You Create a Fair Prenuptial Agreement

Marriage is a pursuit of the heart, but it’s also a legal arrangement. A prenuptial agreement helps protect each partner in the event of divorce.

There are misconceptions that a prenup starts a marriage on the wrong foot or is only for wealthy people. The truth, however, is that it’s a smart financial move that provides you with peace of mind should verbal promises fall by the wayside.

When searching for a prenup lawyer , look for a qualified family law professional with experience. Contact Mims Ballew Hollingsworth Family Law now to schedule a consultation and discuss your goals for a prenuptial agreement.

Content reviewed by a Board Certified family law attorney Constance Mims.

FAQs

A prenuptial agreement, or premarital agreement, is a written contract signed by a couple before marriage that details financial arrangements like division of assets and spousal support in the event of a divorce.

There are several potential benefits to a prenuptial agreement, including financial transparency, protection of inheritance or business interests, and peace of mind.

The cost of a prenuptial agreement starts around $500 for a simple, straightforward contract, growing to $3,000 or more depending on factors like how complex the partners’ assets and debts are, how long negotiations take, and how many changes and drafts are made.

If a prenup is written and signed, features full financial disclosure by both parties, is voluntarily entered by both parties, and has fair and legal terms, it should be enforceable.

It is not required that both parties have separate attorneys for a prenup in Texas, but it is strongly recommended to ensure that the agreement is valid and enforceable.