Divorce involving children can be complex. Understanding the facts about child support and some basic child support statistics can help parents ensure the financial well-being of their children during and after divorce. For parents facing this transition, grasping how Texas courts determine child support obligations can provide clarity and empower them to advocate effectively for their children’s needs.

In Texas, parents share equal rights and responsibilities where children are concerned, whether married or not. When it comes to child custody, the court is tasked with acting in the best interests of children. This could mean a relatively balanced arrangement for custody and parenting time, or one parent could become the custodial parent. Often, courts favor joint managing conservatorship when it comes to making important decisions about education, healthcare, or religion. This means that both parents share responsibilities and rights regarding a child’s upbringing.

Parents may enter into child support agreements (formal/legal and informal), which could be court-ordered or agreed upon by the parents. These agreements are intended to ensure that each household in which the children reside has adequate financial resources. Unfortunately, not all parents live up to their financial obligations.

An experienced child support attorney from Mims Ballew Hollingsworth (MBH) can guide you through the divorce process, help you create strategies to reach child custody and support goals, and help enforce court ordered support payments.

What do you need to know about seeking and receiving support payments in Texas, and what do child support statistics show?

Get In Touch With Us

How Child Support Is Calculated in Texas

In Texas, approximately 1.9% of marriages end in divorce annually, which is lower than the national rate of 2.3%. About half of all divorces in Texas involve a child under age 18, which means child support may be involved. During the divorce process, parents may come to an agreement regarding custody and child support on their own, or the court may step in and decide.

Several factors impact how child support is calculated in Texas, but the amount is primarily based on the net income of the noncustodial parent. Typical child support calculations are as follows:

| # Children | % of Paying Parent’s Net Income |

| 1 | 20% |

| 2 | 25% |

| 3 | 30% |

| 4 | 35% |

| 5 or more | 40% |

These amounts of child support may be adjusted based on circumstances like how much each parent earns, specific custody arrangements, insurance payments made by each parent, or existing child support payments for other children.

U. S. Child Support Facts

As of 2018, U.S. Census Bureau data indicates there were approximately 12.9 million custodial parents in the U.S. Just under 80% of these parents were mothers. Accordingly, just over 20% of these custodial parents were fathers. Of these custodial parents, nearly half (about 49%) have a court order, child support award, or some other agreement in place to receive financial support from the noncustodial parent.

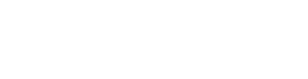

In a perfect world, every one of these parents would receive the financial support owed to them for the care of their children, but unfortunately, this is not the case. The Census Bureau reports that for 2017, only 45.9% of parents receive the full amount of child support owed to them. Of the 54% of non custodial parents that do not pay the full amount of child support payments owed, about 30% paid no child support at all.

Collecting Unpaid Child Support: Statistics of Interest

What happens when child support goes uncollected? In the United States, federal and state governmental agencies assist custodial parents in collecting child support. Federally, the Office of Child Support Services (OCSS), an Office of the Administration for Children & Families within the U.S. Department of Health & Human Services, oversees the national program, while the Department of Justice may intervene in egregious interstate cases.

In Texas, the Child Support Division of the Office of the Attorney General (OAG) is the primary state agency that assists with locating parents, establishing paternity and support orders, and enforcing those orders through various methods like income withholding and license suspension. The division administers 1.5 million child support cases, serving 1.7 million children in Texas. The Child Support Division collects $11.34 for every $1 spent to operate the program. Custodial parents in Texas can apply for these services through the OAG.

Measuring Texas’s Child Support Collections

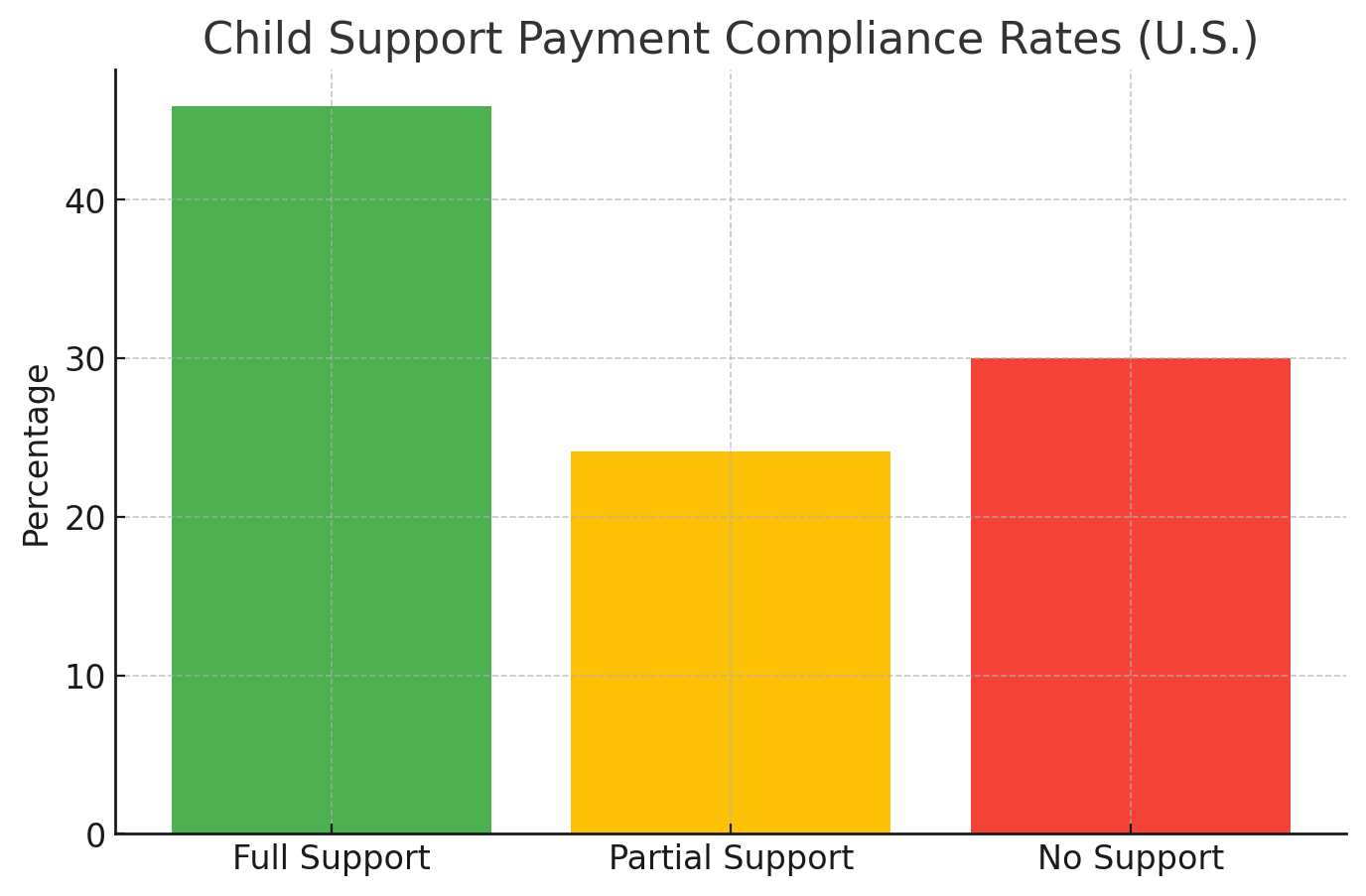

Based on data from 2018, Texas collected the highest total amount of child support payments among all states, totaling $4.2 billion. The next highest was California, with $2.4 billion. This suggests that in terms of the sheer volume of money collected, Texas is a leading state.

However, looking at child support collected per capita in 2018, Texas ranked last at $6.92 per person. This metric considers the state’s population and indicates a different perspective on the efficiency or intensity of child support collection relative to the population size. Arizona, for example, ranked highest in per capita collection at $23.16.

It’s also important to note that there isn’t a consistently updated, nationwide dataset that precisely ranks states by the total amount of child support collected each year. The figures can vary depending on the reporting period and the source of the data. During the state fiscal year 2020, the Texas Attorney General’s Child Support Division announced a record collection of more than $4.8 billion in child support for Texas children. This figure surpassed the previous year’s record by 10%.

Child Support Facts: Arrearages

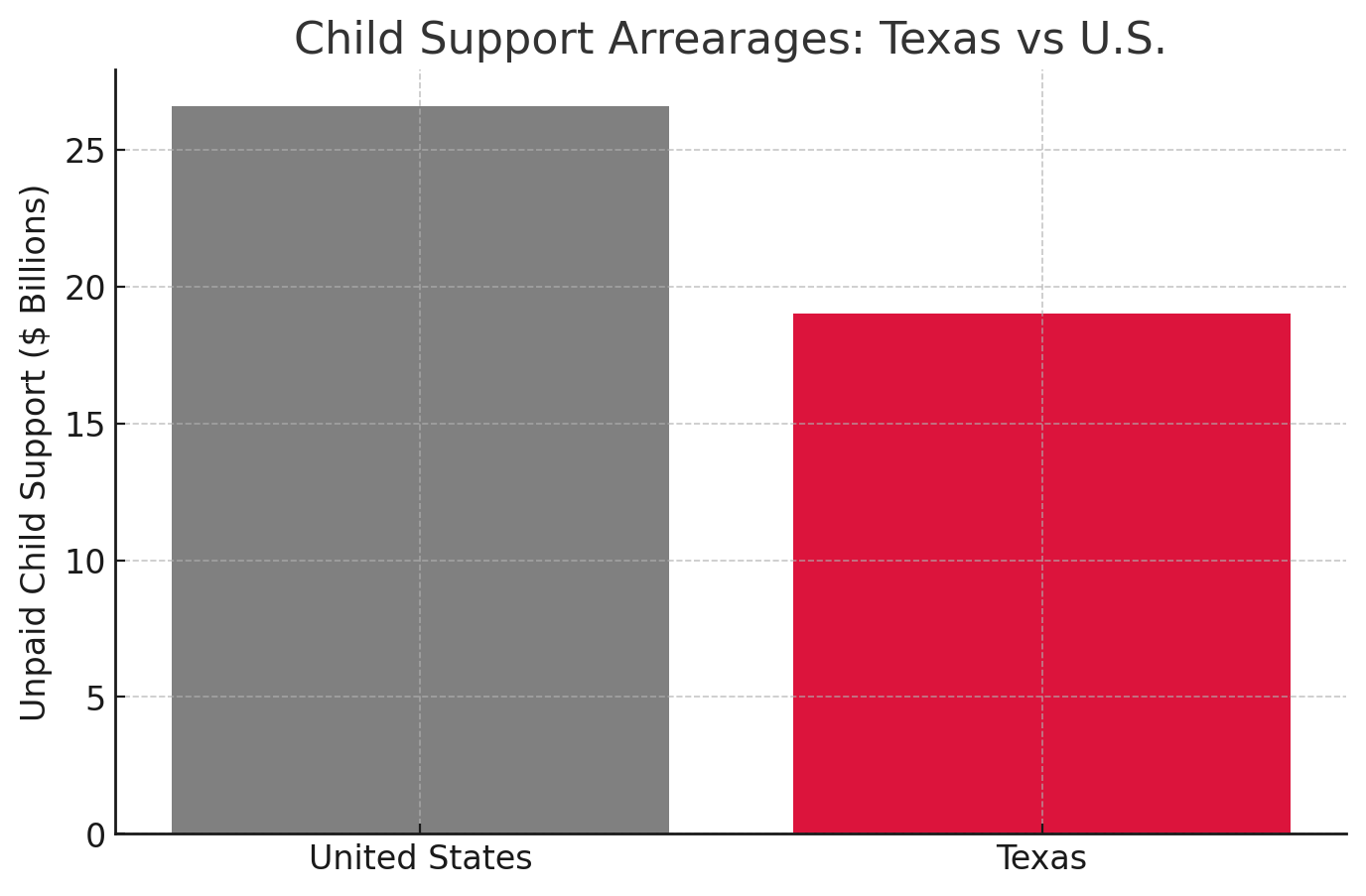

According to the OCSS’s preliminary report for Fiscal Year 2023 (which typically runs from September 1, 2022, to August 31, 2023), the total child support arrears (unpaid child support debt) in the U.S. amounted to over $26.6 billion.

According to a bill analysis document filed with the Texas Senate in April 2025, Texas parents owe approximately $19 billion in unpaid child support. Noncustodial parents who fail to make timely payments are charged a 6% interest rate on monies that are in arrears. (Texas Legislature Online – Bill Analysis SB 629 seeks to lower the 6% interest rate on arrearages.)

The Office of the Attorney General (OAG) has an array of tools and enforcement actions at its disposal to collect back child support. Here are some of the key tools the Texas OAG uses:

- Income Withholding (Wage Garnishment)

- Suspension of Driver’s license

- Suspension of Professional Licenses (medical, legal, teaching)

- Passport Denial for arrears over $2,500

- Liens on real property, bank accounts, retirement plans, life insurance policies, insurance settlements and awards

- Tax refund interception

- Denial of vehicle registration renewal

- Lottery winning interception

- Criminal charges

- Contempt of court

- Seizure of bank accounts

Criminal nonsupport is a felony in Texas and is punishable by up to two years in jail and up to a $10,000 fine.

According to the Texas Office of the Attorney General (OAG), over 80% of all child support collections in cases enforced by the Child Support Division are made through wage withholding (income withholding).

| STATE | Offset of Federal Tax Refund | Offset of TWC

Unemployment Payments |

AEI and Other | Income W/H | Other States or Tribes | Other Countries | Total Collections Received |

| TEXAS | $246.4 | $38.3 | $1,026.6 | $3,472.2 | $69.6 | $0.2 | $4,853.3 |

Source: OCSS FY 2023 PRELIMINARY REPORT

The Evaders

Parents who owe more than $5,000 in support, have not paid in six months or more, and have a warrant out for their arrest could be added to a list on the state’s Child Support Evader website. This list includes the name and photograph of evaders who meet specific criteria, such as those detailed above, plus others, and have thus far avoided apprehension. Evaders on the list owe substantial amounts of money in back support, with several owing over $100,000.

Order Modifications

A child support order in Texas can be modified if it’s been at least three years since the last order, and the monthly amount differs by either 20% or $100 from the current guidelines. The three-year rule may be waived if there has been a substantial change in circumstances (such as an income change or illness). Texas law mandates that child support orders include provisions for medical and dental support, ensuring children’s health needs are met. Courts can order retroactive support for up to four years prior to the date of the petition, under certain circumstances.

Frequently Asked Questions About Child Support in Texas

What are the latest child support payment and collection rates in Texas?

Texas does not report the payment rates of parents who owe child support, or their success rates when collecting delinquent child support. Nationally, only about 45.9% of parents receive the full amount of child support owed to them.

How does Texas compare to national averages for child support enforcement?

Texas consistently stands out as a national leader in child support enforcement, particularly in terms of the sheer volume of money collected and its cost-effectiveness. The Texas Attorney General’s Child Support Division routinely says it ranks first among all states, territories, and districts for the total amount of child support collected annually, often collecting billions more than the next closest state. Additionally, Texas boasts an exceptional cost-effectiveness ratio, recovering significantly more dollars for every dollar spent on its program compared to the national average

What’s the difference between formal legal and informal child support agreements?

The primary difference between formal legal and informal child support agreements lies in their enforceability. A formal legal agreement is a written document that has been reviewed and approved by a court and then becomes a binding court order. This means it carries the full weight of the law, and if a parent fails to comply, the other parent can seek enforcement through the court, including wage withholding, license suspension, and other legal remedies.

In contrast, an informal child support agreement is a private understanding between parents that has not been formalized by a court. While it might seem convenient to avoid legal fees, these agreements are generally not legally enforceable. If one parent stops paying or changes their mind, the other parent has no immediate legal recourse to make the other parent pay without first obtaining a formal court order, which can involve quite a bit of time and expense.

How do poverty and public assistance affect the amount of support received?

Poverty significantly impacts child support in Texas as the amount owed is directly tied to the non-custodial parent’s income, with lower earners having reduced obligations under “low-income guidelines.” When a custodial parent receives public assistance like Temporary Assistance for Needy Families (TANF), they are usually required to cooperate with the Attorney General’s child support efforts. In such cases, the state often keeps a portion of the collected child support to reimburse itself for the public assistance provided, though families typically receive the first $75 collected each month.

Don’t Be an Unhappy Child Support Statistic

Need a modification of your support orders? Not receiving the court ordered payments owed to you? An experienced family law attorney can provide additional child support resources to pursue court ordered payments.

Get In Touch With Us

We put you and your family first! Whether you are facing divorce, seeking adoption, or have a child custody case, you can rely on our legal team. Contact us today for a case review or legal consultation.

Client Reviews

What our clients are saying about us

Kam J.

View More Reviews on Google Maps